Municipal bond issuers in the Northeast sold $115 billion of debt in 2,261 deals during 2021, an 11.7% volume decline from 2020, according to Refinitiv data.

The Dormitory Authority of the State of New York was the top issuer in both the region and in the nation last year. In 2021, DASNY issued $7.86 billion of bonds in 29 deals, up from 2020 when it sold $5.46 billion in 25 transactions.

“DASNY’s exceptional finance team has consistently made DASNY a national leader in the municipal bond market through the years,” DASNY President and CEO Reuben R. McDaniel III told The Bond Buyer. “Our team’s depth of expertise has provided tremendous opportunities for our public and nonprofit clients, and we look forward to another year of success.”

Bloomberg News

The authority’s wide remit belies its name, ranging from operating as a conduit issuer for non-profits to selling state government debt.

DASNY also sold the largest single regional issue, a $2.5 billion tax-exempt and taxable personal income tax revenue bond competitive sale for the state government in early December. Morgan Stanley won two tranches of that deal while Citigroup, BofA Securities, RBC Capital Markets and Wells Fargo Corporate & Investment Banking took one tranche each.

DASNY issued three of the five largest deals sold in the region last year. The others were a $2.2 billion negotiated PIT offering in March and a $1.9 billion negotiated PIT issue done in June.

The Empire State Development Corp. had the second biggest deal with a $2.4 billion tax-exempt and taxable competitive deal in October and the New York State Thruway Authority competitively sold $1.95 billion of tax-exempts and taxables in July to take fifth place.

The sixth-biggest deal, and the only deal among the region’s 15 largest from outside New York, came from the Puerto Rico Aqueduct and Sewer Authority with a junk-rated $1.7 billion refunding in August.

Other top issuers in the Northeast included the New York City Transitional Finance Authority, which sold $5.49 billion in 12 deals, up from $5.07 billion in 19 deals in the prior year. It ranked fourth in the nation last year, up from 2020 when it ranked sixth.

The State of Connecticut sold $3.3 billion of debt last year, making it the Northeast’s third biggest issuer and largest outside New York.

The Triborough Bridge and Tunnel Authority sold $3.05 billion of bonds in 22 deals, up from $525 million in two transactions in 2020; it surged to seventh place nationally from 156.

The TBTA’s $1.24 billion payroll mobility tax senior lean deal for MTA Bridges and Tunnels was The Bond Buyer’s Deal Of The Year winner for the Northeast Region.

The TBTA deal marked the first new financing credit for the MTA’s transit and commuter capital program since its 2002 restructuring and marked the first long-term issuance under the security. The deal was priced by Goldman Sachs in April; bond counsel was Nixon Peabody and the financial advisor was Public Resources Advisory Group

The New York City Housing Development Corp. sold $2.98 billion in 19 deals, up from $2.18 billion in 19 deals, pushing its ranking up to eight from 22 in 2020.

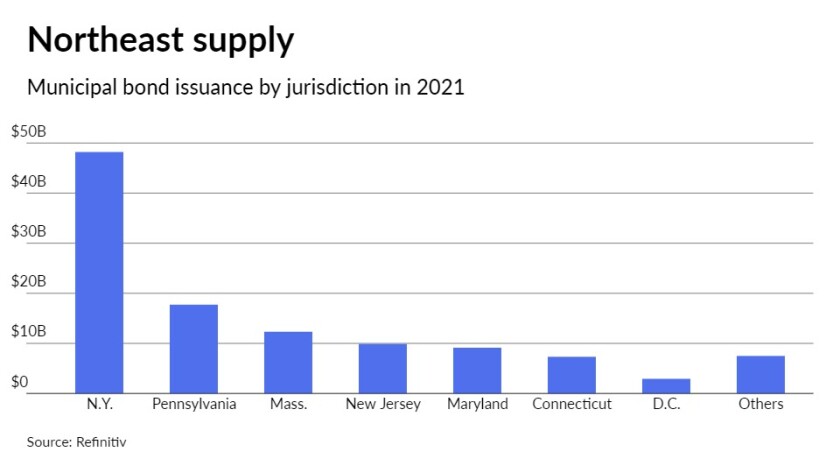

New York was tops in the region — and ranked third in the nation — as a source of municipal bonds with issuers in the state selling $48.2 billion in 775 deals, down 15.5% from 2020 when $57.1 billion were sold in 741 deals.

The Northeast is comprised of 11 states, the District of Columbia, Puerto Rico and the U.S. Virgin Islands.

New York was one of six states, along with the District of Columbia, to see volume decline from 2020 while four states and the Commonwealth of Puerto Rico saw increases in volume. No issuance was recorded from the Virgin Islands in either year.

Delaware saw the largest decline, falling 50.8% to $821.3 million in 11 deals from $1.67 billion in 21 deals in 2020.

Massachusetts fell 18.5% to $12.32 billion; Maryland dropped 8.2% to $9.1 billion; New Hampshire was off 23.6% to $1.66 billion; New Jersey fell 22.4% to $9.9 billion; and D.C. fell 7.4% to $2.93 billion.

While taking last place in the regional rankings, Vermont saw the biggest volume increase, gaining 88.4% to $423.4 million in 20 deals last year from $224.7 million in seven deals in 2020.

Rhode Island rose 43.9% to $1.56 billion; Connecticut rose 13.6% to $7.33 billion; Maine increased 3.6% to $1.31 billion; and Puerto Rico gained 5.8% to $1.71 billion.

New money and refunding volume dropped last year in the Northeast — though refunding took a bigger hit, reflecting the national trend.

New money issues fell 2.2% to $89.21 billion; and refundings dropped 32.1% to $18.21 billion from $26.81 billion in the prior year. Deals Refinitiv classifies as combining new money and refunding issues fell 38.1% to $7.6 billion.

Tax-exempt volume fell 9.7% to $88.02 billion from $97.5 billion while taxables dropped 19.0% to $23.24 billion from $28.67 billion in 2020.

General obligation issuance dropped 28.3% to $37.48 billion from $52.24 billion while revenue bond issuance dipped 0.7% to $77.54 billion.

Looking at the sectors, bonds issued for education fell 31.0% to $16.61 billion from $24, healthcare dropped 27.5% to $6.40 billion and utilities dropped 14.6% to $8.04 billion from $9.41 billion.

Transportation sector volume was up 5% to $24.35 billion and housing bond issuance increased 11.9% to $10.13 billion from $9.05 billion.

Leading the pack of managing underwriters in the Northeast was BofA Securities, credited by Refinitiv with underwriting $20.06 billion of business last year over 166 deals. It was followed by Citigroup, credited with $14.31 billion, Goldman Sachs, J.P. Morgan Securities and RBC Capital Markets.

The top financial advisor in the Northeast was Public Resources Advisory Group, credited with advising on $22.25 billion of deals. It was followed by PFM Financial Advisors, at $14.44 billion, Frasca & Associates, Acacia Financial Group and HilltopSecurities.

Nixon Peabody was the top bond counsel, credited with $10.55 billion of deals. It was followed by Hawkins Delafield & Wood, Bryant Rabbino, Locke Lord and Orrick Herrington & Sutcliffe.

The use of bond insurance, tacking against the national wind, was down 10.9% in the Northeast to $8.03 billion in 458 issues from $9.01 billion in 463 issues in 2020. Across the nation, insured bond volume rose 9% in 2021 to $37.52 billion, up from $34.43 billion in the previous year.

Nationally, municipal bond issuance in 2021 totaled $480.028 billion in 12,935 deals, according to Refinitiv, down slightly from 2020’s total of $484.622 billion in 13,328 transactions.