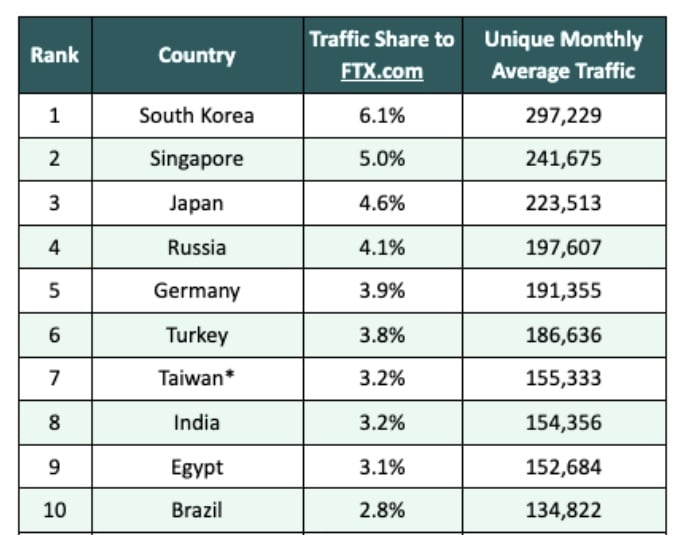

A new analysis shows that the countries most impacted by the collapse of cryptocurrency exchange FTX are South Korea, Singapore, and Japan. Moreover, Russia, Germany, Turkey, Taiwan, India, Egypt, and Brazil also made the top 10 list of countries most affected by the FTX meltdown.

Countries Most Impacted by FTX Failure

South Korea, Singapore, and Japan top the countries most impacted by the collapse of the cryptocurrency exchange FTX, according to an analysis by Coingecko, published Thursday. The study examines FTX.com’s monthly unique visitors and traffic by country based on Similarweb data from January to October. The crypto exchange filed for Chapter 11 bankruptcy on Nov. 11.

According to the analysis, South Korea is most impacted by the fallout of FTX as 297,229 unique users from the country visited FTX.com monthly on average. This represented 6.1% of the website’s traffic.

The next most-impacted country is Singapore where 241,675 unique users visited the FTX website monthly, representing 5% of the site’s traffic globally. When Binance shut down its Singapore operations in December last year, Binance users reportedly switched to FTX.

The third most-impacted country is Japan where 223,513 unique users visited the FTX website monthly, accounting for 4.6% of the website’s traffic. Earlier this year, Japanese conglomerate Softbank invested $100 million in FTX.

Besides the three aforementioned countries, Russia, Germany, Turkey, Taiwan, India, Egypt, and Brazil also made the top 10 list of countries most impacted by the meltdown of FTX. The analysis shows that only 92,935 FTX site visitors were from the U.S. However, it does not include traffic to FTX US which uses a separate domain.

FTX is currently under investigation in various countries. In the U.S., the Department of Justice (DOJ), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC) are investigating the exchange for mishandling customer funds. Turkey’s financial intelligence unit started investigating FTX last week. The Bahamas Securities Commission has been trying to seize FTX’s cryptocurrencies.

The new FTX CEO, John J. Ray, III, who replaced Sam Bankman-Fried following the bankruptcy filing, said last week: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

What do you think about all the countries impacted by the collapse of FTX? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer