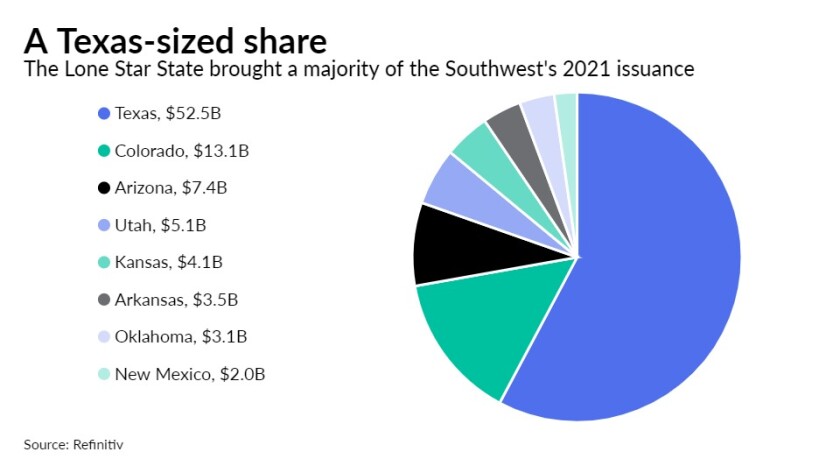

Municipal bond issuers in the Southwest sold $90.8 billion of debt in 2021, down 3.2% from 2020, according to Refinitiv data, as lost refunding volume outpaced a gain in new-money sales.

Texas weighed down the region, as volume in the Lone Star State fell 12% to $52.4 billion, outpacing gains in some other fast-growing Southwest states.

That first glance, though, may be a bit deceiving.

Bloomberg News

“I think the year before was really big,” said Trey Cash, a managing director at Masterson Advisors. “It wasn’t so much that last year was a real down year but we were coming off a big year.”

And that is true: Texas bond issuers in 2020, despite the COVID-19 pandemic’s onset, had a banner year, with volume up 35% from the previous year, hitting $59.5 billion.

Even after the 2021 fall, volume in Texas was up more than 18% compared to 2019.

The same story plays out for the Southwest as a whole: Regional municipal bond volume in 2021 beat 2019 numbers by 14%.

New money issuance in the region, reflecting national trends, experienced a robust gain in volume and in number of deals; issuers priced 1,973 new-money deals for $52.9 billion, a 35% volume increase from $39.1 billion on 1,768 deals in 2020.

But refunding deals were off by 35% in the region, with volume falling to $25.4 billion and the number of deals down by 391 to 1,003.

Deals Refinitiv classified as combining new-money and refunding were down almost 20% to $12.5 billion.

Debt classified for education represented the largest sector at $30.4 billion, down 7.2% from 2020. The region’s issuers sold $12.4 billion of transportation debt, a fall of almost 30%.

Tax-exempt issuance was up 4.4% year-over-year in the Southwest to hit $63.9 billion. But the volume of taxable bond sales fell more than 22% to $24.4 billion.

The use of bond insurance was up, reflecting significant growth nationwide.

Issuers in the Southwest wrapped 791 deals for $9.96 billion, up 52% in volume from the 697 deals wrapped in 2020 for $6.5 billion. That brought bond insurance to almost 11% of the Southwest market.

And the 12% drop in Texas pushed the region’s year-over-year volume comparison into the red.

The education sector in Texas was down 22.2% year-over-year to $17.7 billion, reflecting a national slippage.

Transportation was down 35% in Texas to $8.8 billion, even as the sector gained nationwide.

Texas taxable volume was off substantially from 2020, with volume down 40.7% to $13.7 billion.

Tax-exempt volume gained slightly in the Lone Star State, up 4.1% to $37.2 billion on 1,475 transactions, eight more than the year before.

Texas’ 2020 refunding boom quieted in 2021, with volume down 46.1% to $16.1 billion as the number of refunding deals fell to 601 from 838.

But new-money sales jumped 49.6%, reaching $28.7 billion in a gain that did not quite offset the loss of refunding volume. Individual new-money deals were up as well, hitting 1,033, from 872 the year before, according to Refinitiv.

Deals classified as combined were down 28.1% to $7.7 billion.

The new-money volume gain in Texas outpaced the national trend, in which volume was up 15.8%.

Broader economic indicators are also pointing upward in the Lone Star State.

State Comptroller Glenn Hegar, in his most recent sales tax report on Feb. 1, reported that Texas received $3.85 billion in sales tax revenue in January, a 25.3% increase over January 2021. The majority of January sales tax revenue is based on sales made in December and remitted to the agency in January.

Most tax revenues continue to be affected by base effects, he said; revenue collections in 2021 were suppressed by the pandemic.

But compared to January 2020, before the pandemic, sales tax collections were up 24.9%.

“January state sales tax collections reached another all-time monthly high, with receipts from almost all major economic sectors rocketing above year-ago levels,” Hegar said.

“Fueled by continued strength in both business and consumer spending, receipts from most sectors strongly surpassed pre-pandemic levels,” he said.

“Business spending drove double-digit increases in receipts from the oil and gas mining, manufacturing, wholesale trade and construction sectors, with receipts from only oil and gas mining remaining below pre-pandemic levels,” Hegar said.

Volume was up in five of the region’s eight states.

Among the big gainers was Colorado, where issuers sold $13.1 billion of bonds, up 22% from 2020, comfortably holding the state’s position as the number-two source of municipals in the Southwest.

Utah saw the biggest percentage gain, up 25.3% to $5.1 billion.

Fast-growing Arizona also saw a significant gain, up 12% to $7.4 billion.

New Mexico was up 22.9% to more than $2 billion.

Oklahoma saw the biggest drop, with volume falling 18.7% to $3.1 billion.

Arkansas was down 1.2% to $3.5 billion.

The city of Houston was Texas’ top issuer, credited with almost $1.3 billion on nine transactions. It finished just ahead of Dallas Fort Worth International Airport, credited with three deals totaling more than $1.2 billion.

All six of the Southwest’s largest issuers were from Texas; Salt Lake City was the biggest issuer elsewhere in the region, credited with $949 million as the city advanced a major airport project.

Salt Lake’s $904.6 billion airport deal in July was the region’s second largest all year, trailing only a $1.1 billion refunding by the Texas Municipal Gas Acquisition and Supply Corp. in January.

RBC Capital Markets topped the Texas league table for underwriters, credited by Refinitiv with $4.2 billion in volume on 116 deals. Next in line were Morgan Stanley, Raymond James, BofA Securities and JPMorgan Securities.

HilltopSecurities clocked in as the Lone Star State’s top financial advisor, credited with almost $13.8 billion on 356 deals. Estrada Hinojosa & Co. was next at $4.96 billion, followed by Specialized Public Finance, RBC Capital Markets and PFM Financial Advisors.

Leading the Texas bond counsel table was McCall Parkhurst & Horton, credited with $14.2 billion on 431 deals, ahead of Bracewell at $9 billion, followed by Norton Rose Fulbright, Orrick Herrington & Sutcliffe and West & Associates.

The same three firms finished in the same order in the tally for the region as a whole.

RBC topped the Southwest regional underwriting table, credited by Refinitiv with $7.8 billion on 182 transactions, ahead of JPMorgan Securities and Piper Sandler & Co.

Hilltop’s dominance among Texas municipal advisors carried it to the top of the regional table with $17.9 billion on 406 deals. RBC was second at $5.3 billion, followed by PFM at $5.1 billion.