Municipals were mostly firmer to kick off August, while U.S. Treasuries rallied out long and equities were in the red near the close.

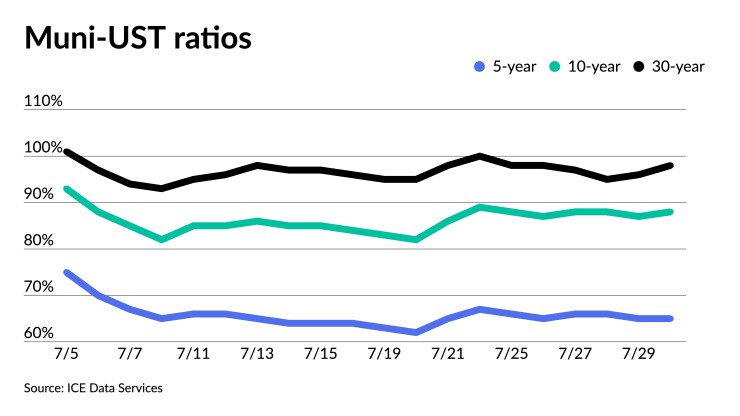

Muni-UST ratios on Monday were at 67% in five years, 84% in 10 years and 98% in 30 years, according to Refinitiv MMD’s 3 p.m. read. ICE Data Services had the five at 65%, the 10 at 88% and the 30 at 98% at a 3:30 p.m. read.

Summer redemption season starts winding down after Monday when issuers “return $26.8 billion of maturing and called bond principal, plus $8.6 billion of interest,” said Pat Luby, CreditSights municipal strategist.

A total of $41.5 billion of bonds will be redeemed, the third highest monthly total of the year after June with $50.6 billion and July with $42.5 billion.

Of the bonds redeemed this month, 26% will be from issuers in California, he noted.

August redemption flows will be the heaviest month of the year also in Maryland and Massachusetts, Luby added.

“The surge in returned principal should help to buoy the market for California bonds and should also help drive demand for next week’s $990 million Los Angeles airport revenue bonds,” although most of those bonds will be subject to the alternative minimum tax, with only $209 million of non-AMT, according to Luby.

“August redemptions from New York issuers will total $4 billion, the third most of any state, but it will not be the biggest month of the year for the state,” he said.

New York redemptions peaked in June at $6.9 billion, and July’s totaled $3.5 billion. Redemptions in November are currently expected to total $4.5 billion.

Bond Buyer 30-day visible supply is at $12.06 billion while net negative supply is at $18.777 billion, per Bloomberg data.

July in the black

For just the second time in this year, munis swung to a month-end positive return, said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

The about-face for returns marks an almost 420-basis point journey for tax-exempts from June until now, he said.

“Contributing factors included the heavy pressure from seasonal cash rolls as well as continued rate volatility, which has made municipal performance look all the better when compared with that of U.S. Treasuries for July,” he noted.

“Munis have returned roughly 2.64% according to Bloomberg index data for the month, making it the best month-to-month returns of the year and only the second positive monthly return, besting May’s return of just 1.5%,” said Jason Wong, vice president of municipals at AmeriVet Securities.

Across the muni curve, there were positive returns for July with the long end having the best returns of 3.77%. Taxables also showed some positive gains by returning about 1.92% for the month. Munis bested USTs as they returned just 1.59%, he said.

But “municipal bonds’ summer loving may be coming to a prolonged end during August, the last heavy-cash month for muni investors,” Kazatsky said. “Though muni returns have benefited from July tailwinds, the true test for exempt viability vs. other fixed-income options will be performance when we return from the beach.”

July details

The Bloomberg Municipal index saw positive 2.64% returns in July, bringing year-to-date losses down to 6.58%. High-yield saw 3.73% returns, moving losses to 8.48% in 2022 and taxables posted 1.92% gains in July, moving losses year-to-date to 12.13%.

The long end (22+ years) performed the best in July with the Bloomberg index seeing 3.77% returns in July, moving losses to 11.45% year-to-date. General obligation bonds were 2.58% in the black while revenue bonds were 2.79% positive.

Bloomberg’s Impact Index saw 3.09% gains in July and 8.94% losses year-to-date. The green index saw 2.92% returns, moving losses to 8.17% in 2022; its social index saw 3.46% positive returns in July with 12.05% losses in 2022; and its sustainable index saw 3.82% positive returns in the month and 10.68% losses year-to-date.

Secondary trading

Georgia 5s of 2023 at 1.46%-1.45%. NYC TFA 5s of 2023 at 1.56% versus 1.69% Thursday. Maryland 5s of 2025 at 1.63%.

Austin, Texas, 5s of 2029 at 2.23% versus 2.26%-2.27% Friday and 2.62% Thursday. Minnesota 5s of 2030 at 2.05%-2.03% versus 2.11%-2.08% Friday. California 5s of 2032 at 2.22%-2.20% versus 2.38%-2.34% Wednesday.

Maryland 5s of 2035 at 2.42% versus 2.49% Thursday and 2.52% Wednesday. Washington 5s of 2036 at 2.70% versus 2.75% Thursday and 2.91% original (on 7/20). Tarrant County College District, Texas, 5s of 2036 at 2.67%.

San Diego County, California, 5s of 2039 at 2.87%-2.82%. South Carolina 5s of 2040 at 2.69% versus 2.75% Friday and 2.80% on Tuesday. District of Columbia 5s of 2041 at 2.93%-2.94% versus 3.05% Thursday and 3.07% Wednesday.

MTA 5s of 2047 at 3.47%-3.44%. NYC TFA 5s of 2051 at 3.53%-3.52% versus 3.60%-3.58% Wednesday and 3.70%-3.65% Tuesday.

AAA scales

Refinitiv MMD’s scale was mixed at 3 p.m. read: the one-year at 1.41% (unch +3 bp Aug. roll) and 1.61% (unch +1 bp Aug. Roll) in two years. The five-year at 1.79% (-2 +1 bp Aug. roll), the 10-year at 2.19% (-2, no roll) and the 30-year at 2.87% (-2).

The ICE AAA yield curve was bumped up to two basis points: 1.47% (flat) in 2023 and 1.59% (-2) in 2024. The five-year at 1.77% (-2), the 10-year was at 2.25% (-2) and the 30-year yield was at 2.88% (flat) at 3:30 p.m.

The IHS Markit municipal curve saw bumps five years and out: 1.38% (unch) in 2023 and 1.62% (unch) in 2024. The five-year was at 1.79% (-3), the 10-year was at 2.18% (-3) and the 30-year yield was at 2.86% (-3) at a 3 p.m. read.

Bloomberg BVAL was bumped one to three basis points: 1.32% (-1) in 2023 and 1.56% (-2) in 2024. The five-year at 1.78% (-2), the 10-year at 2.22% (-3) and the 30-year at 2.84% (-2) at 3:30 p.m.

Treasuries were mixed.

The two-year UST was yielding 2.901% (+1), the three-year was at 2.821% (+1), the five-year at 2.660% (-2), the seven-year 2.660% (-2), the 10-year yielding 2.647% (-3), the 20-year at 3.114% (-9) and the 30-year Treasury was yielding 2.920% (-9) near the close.

Primary to come:

The Port of Seattle, Washington, (A1/AA-/AA-/) is set to price Tuesday $878.750 million, consisting of $211.715 million of non-AMT intermediate lien revenue refunding bonds, Series 2022A, serials 2025-2033, $595.190 million of private activity AMT intermediate lien revenue and refunding bonds, Series 2022B, serials 2023-2042, term 2047 and $70.835 million of taxable intermediate lien revenue and refunding bonds, Series 2022C. Citigroup Global Markets.

The Tarrant County Culture Education Facilities Finance Corporation, Texas, (A1//A+/) is set to price Thursday $323.615 million of Christus Health bonds, consisting of $300 million of revenue bonds, Series 2022A and $23.615 million of revenue refunding bonds, Series 2022B. RBC Capital Markets.

The Forney Independent School District, Texas, is set to price Wednesday $283.785 million of unlimited tax school building bonds (/AAA//), Series 2022B, serials 2033-2042, terms 2047 and 2052, insured by the Permanent School Fund Guarantee Program. Raymond James & Associates.

The Galveston Independent School District, Texas, (Aaa///) is set to price Tuesday $250 million of unlimited tax school building bonds, Series 2022, serials 2023-2042, term 2047, insured by the Permanent School Fund Guarantee Program. HilltopSecurities.

Midland, Texas, (Aa1//AAA/) is set to price Tuesday $157.050 million of taxable general obligation refunding bonds, Series 2022A, serials 2030-2050. Raymond James & Associates.

The Michigan State Building Authority (Aa2//AA/) is set to price Tuesday $148.710 million of Facilities Program 2022 revenue bonds, Series I. Morgan Stanley & Co.

The Private Colleges and Universities Authority, Georgia, (Aa2/AA//) is set to price Wednesday $101.960 million of Emory University fixed rate revenue bonds, Series 2022A. Goldman Sachs & Co.

Competitive:

Miami-Dade County, Florida, (Aa3/AA//) is set to sell $89.270 million of capital asset acquisition special obligation bonds, Series 2022A, at 10 a.m. eastern Tuesday.